Pv(

Rate: Double;

PeriodCount: Integer;

PeriodPayment: Double;

FutureValue: Double;

Type: Integer): Double;

| Parameters | Description | Constraints |

| Rate | Loan interest rate. | Cannot be negative. |

| PeriodCount | Total number of annuity payment periods. | Must be positive. |

| PeriodPayment | A payment, done every period, which does not change over the time of paying the rent. Payments usually include primary payments and interest payments, but do not include taxes. | |

| FutureValue | The required value of future cost, or the remainder after the last payment. If the argument is missing, it is supposed to be equal to 0 (future value of a loan, for example, is equal to 0). | |

| Type | Selecting time of payment: 0 - in the end of the period. 1 - in the beginning of the period. |

Must take the values 0 or 1. |

The Pv method returns net present (at the current moment) value of investment.

Investment value is calculated based on the calculation of the following equations:

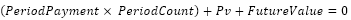

If the rate is 0,

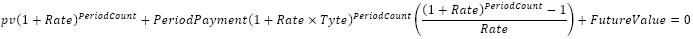

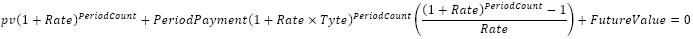

If the rate is not 0,

To execute the example, add a link to the MathFin system assembly.

Sub UserProc;

Var

r: Double;

Begin

r := Finance.Pv(0.15, 12, 122, 12000, 1);

Debug.WriteLine(r);

End Sub UserProc;

After executing the example the console window displays the investment value equal to 3003.399.

See also: