,

,YieldDisc(Settlement: DateTime; Maturity: DateTime; Price: Double; Redemption: Double; [Basis: Integer = 0]): Double;

Settlement. The payment day on securities. Must be less than Maturity.

Maturity. The security's maturity date. Must be greater than Settlement.

Price. The security's price per $100 face value. Must be positive.

Redemption. The security's redemption price per $100 face value. Must be positive.

Basis. The day calculation method used. Select a value from 0 to 4:

0. Day calculation method - American/360 days (NSAD method). Default value.

1. Day calculation method - Actual/actual.

2. Day calculation method - Actual/360 days.

3. Day calculation method - Actual/365 days.

4. Day calculation method - European 30/360 days.

Optional parameter.

The YieldDisc method returns annual profit for discounted securities.

The agreement date is the date of selling a coupon, for example, a bond, to the buyer. The payment date is the coupon expiry date. Consider a bond with duration of 30 years was issued on Jan 1 2008 and was acquired by a buyer in 6 months after the issue date. The issue date is Jan 1 2008, the settlement date - July 1 2008, and the maturity date is Jan 1 2038, that is 30 years after the issue date.

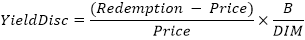

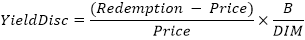

YieldDisc is calculated using the following formula:

,

,

where:

B. The number of days in a year, it depends on the selected Basis argument value.

DIM. The number of days from settlement date to maturity date.

Add a link to the MathFin system assembly.

Sub UserProc;

Var

r: Double;

Begin

r := Finance.YieldDisc(DateTime.ComposeDay(2008,02,16), DateTime.ComposeDay(2008,03,01), 99.795, 100, 2);

Debug.WriteLine(r);

End Sub UserProc;

After executing the example the console window displays the annual profit equal to 0.0528.

See also: