Fv(

Rate: Double;

PeriodCount: Integer;

PeriodPayment: Double;

PresentValue: Double;

Type: Integer): Double;

Fv(

Rate: double;

PeriodCount: integer;

PeriodPayment: double;

PresentValue: double;

Type: integer): double;

| Parameters | Description | Constraints |

| Rate | Interest rate for a period. | Cannot be negative. |

| PeriodCount | Total number of annuity payment periods. | |

| PeriodPayment | Payment, done each period. | |

| PresentValue | Present net value or the total sum, which is currently equal to the set of future payments. | |

| Type | Selecting time of payment: 0 - in the end of the period. 1 - in the beginning of the period. |

Must take the value 0 or 1. |

The Fv method returns future value of the investment, at the condition of regular equal payments and constant interest rate.

All the arguments, denoting money, which has to be paid (for example, saving accounts), are represented as negative numbers; all the money, which has to be received (for example, dividends), are represented as positive numbers.

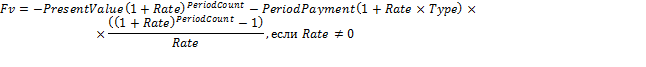

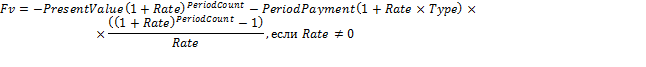

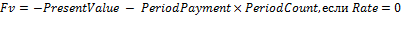

Fv is calculated using the following formula:

To execute the example, add a link to the MathFin system assembly.

Sub UserProc;

Var

r: Double;

Begin

r := Finance.Fv(0.06, 4, -200, -500, 0);

Debug.WriteLine(r);

End Sub UserProc;

After executing the example the console window displays the future investment value equal to 1506.1617.

The requirements and result of the Fore.NET example execution match with those in the Fore example.

Imports Prognoz.Platform.Interop.MathFin;

…

Public Shared Sub Main(Params: StartParams);

Var

r: double;

Finance: FinanceClass = New FinanceClass();

Begin

r := Finance.Fv(0.06, 4, -200, -500, 0);

System.Diagnostics.Debug.WriteLine(r);

End Sub;

See also: